Preparing for the Medicare Part D coverage gap

Author: CenterWell Pharmacy

Date Posted: Jun. 21, 2021

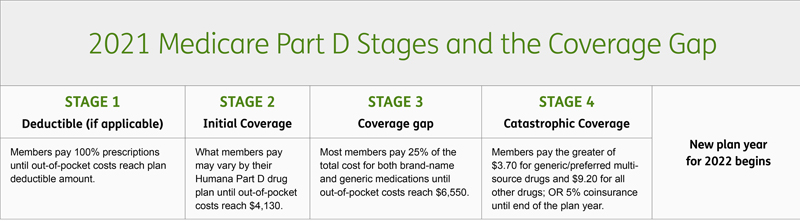

If you have a Medicare Part D drug plan, what you pay for your medications may change based on your coverage stage.

Medicare Part D Coverage stages:

- deductible (if applicable)

- initial coverage

- coverage gap

- catastrophic coverage

Most people recognize this after entering the third stage of their Medicare Part D plan—the coverage gap. While in the coverage gap, you may temporarily pay more for your medications until you reach the next stage of coverage (catastrophic coverage).

We know the coverage gap may be confusing or frustrating for you. And we’re here to make it simple for you to understand how to manage your costs and get prepared for the coverage gap.

What you’ll pay for your meds

Not everyone will enter the coverage gap— it doesn’t apply to members who get Extra Help to pay for their covered medications.¹

This year, most people with Medicare Part D benefits will enter the coverage gap once they’ve spent $4,130 on covered medications.² When this happens, your Humana drug plan will let you know via your monthly explanation of benefits (EOB) statement.

Please be aware, if you have a select Medicare Advantage prescription drug (MAPD) plan, you may have an increased coverage gap limit. This means you may be able to spend more on your covered medications before entering the coverage gap. You can review your Evidence of Coverage document to confirm your plan design details.

What you pay for your medications could vary from the initial coverage stage and the coverage gap stage. This is because your Humana drug plan may charge a lower copayment or coinsurance in the initial stage, instead of 25% of the drug’s total cost in the coverage gap stage. And if you have a group Medicare drug plan, your out-of-pocket costs may vary from the chart above. To learn more about your costs while in the coverage gap, review your Humana drug plan details.

Getting out of the coverage gap

What you spend on your medications while in the coverage gap will go towards reaching catastrophic coverage. Any discounts you receive from the drug maker will also count as out-of-pocket spending, which will help you exit the coverage gap faster.³

Once you’ve spent $6,550 in out-of-pocket costs, you’ve reached catastrophic coverage. This means you’ll pay a small amount of coinsurance or a copayment for your medications until the next plan year.

Managing your costs

To support you, Humana has free tools to help you budget for your Medicare Part D costs. You can estimate your drug spend for the year using Humana’s Rx Calculator, or if you’re a Humana member, sign in to MyHumana to view the “coverage gap (donut hole)” tracker on your dashboard or in the pharmacy section.

Sources:

- “Lower prescription costs,” U.S. Centers for Medicare & Medicaid Services, last accessed May 1, 2021, https://www.medicare.gov/basics/costs/help/drug-costs.

- “Costs in the coverage gap,” U.S. Centers for Medicare & Medicaid Services, last accessed May 1, 2021, https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/costs-in-the-coverage-gap.

- “Phases of Part D coverage,” Medicare Interactive, last accessed May 1, 2021, https://www.medicareinteractive.org/get-answers/medicare-prescription-drug-coverage-part-d/medicare-part-d-costs/phases-of-part-d-coverage.